When you’re looking to lease a commercial property, there will be relatively few occasions that a property of the right size, space, and style will also have the exact elements to match the unique needs of your business. Worse yet, you might be starting your business from scratch with an empty office space and need to build it out completely.

This can be a concerning issue, as it seems you’ll have to invest a significant amount of your capital into adjustments that can get the rental property into a condition that allows you to function effectively. It’s capital that could certainly be better spent on hiring staff, purchasing better equipment, or just giving you a little more financial stability. The good news is, there’s an alternative option available. You can seek out a commercial lease that includes a tenant improvement allowance.

But what exactly is a tenant improvement allowance and how does it work? We’ve put together a guide to the key elements you need to understand about this tool.

What is a Tenant Improvement Allowance?

A tenant improvement allowance is an amount of funding a commercial landlord provides a tenant toward making alterations to the property. There are some nuances, naturally. For example, in single-tenant triple net lease (SNTL) agreements, tenants are typically responsible for property expenses, but landlords may still offer such allowances to attract and retain tenants.

Landowners understand that each company will have individual needs beyond the basic space they’re providing. Simply installing general fixtures and fittings inside a property is unlikely to meet every tenant’s specific requirements, and represents a waste of investment for the landlord. As such, offering an improvement allowance tends to be the most practical and financially responsible route.

This might seem like a generous act on behalf of the landlord, as it’s tantamount to indirectly investing in the success of your business. But it’s important to remember that there are significant advantages for landlords to offer this allowance. With a relatively small up-front investment, they are creating a more suitable environment for their tenants to thrive in. It is in their best interest to bolster the success of tenants as this helps to ensure occupation in the long term. It also helps to forge a more positive relationship with you, their tenant, that you can build on together for years to come. Not to mention that having a successful business in their units can help raise the value of not just that property but also others they may own in the vicinity.

As such, it’s important not to be on the back foot when it comes to seeking a tenant improvement allowance from potential landlords. You’re not asking them to do you a favor by providing this. The outcome tends to be mutually beneficial.

What Forms Can a Tenant Improvement Allowance Take?

There are a few different approaches the majority of landlords will take to providing a tenant improvement allowance. These are:

- An improvement fund

Often the most straightforward and preferable way to approach improvement allowances is with the provision of a fund. This is where you negotiate with your landlord to provide a certain amount of funding up-front that you can utilize in making changes to the property. In some cases, the landlord may provide access to their preferred contractors for any work that needs to be undertaken. This might be offered at a lower rate that benefits both you and the landowner.

- A reimbursement arrangement

In some cases, the landlord won’t provide a pool of capital that you can dip into when making improvements. Instead, they’ll stipulate in the contract that they’re willing to reimburse you up to a certain amount for pre-approved alterations that you make to the property. This can be a difficult method to navigate, particularly if you already have a limited amount of liquid capital at your disposal. After all, you might have negotiated a really positive allowance with the landlord, but you still need to front that with your own funds.

- A rent discount

One of the most commission ways landlords tend to provide a tenant improvement allowance is through a discount in your rent. Rather than arrange a fund or reimbursement, you and your landlord will make an agreement for a set amount to be deducted that represents that entire allowance. This isn’t usually a long-term discount, the amount will be deducted from your first couple of months or first quarter payment. The discount approach gives you a little more freedom to utilize the allowance as you see fit and doesn’t require the landlord to transfer any funds to you.

In some cases, landlords will look at their rent roll to determine which approach is best for them from a financial situation. For example, they can see at a glance that some improvements to a property are coming due. They might even approach you proactively to see if you would like a discount on rent if certain improvements are expected to take more than one day.

What Can You Use a Tenant Improvement Allowance For?

For the most part, a tenant improvement allowance isn’t a fund you can utilize for anything you want to. For instance, you can’t choose to utilize some of the funds for alterations and then apply the remainder to your operating costs or to purchase inventory. It is strictly for the changes you want to make to the property. Remember, while this is a tool that can help your company to function, an allowance isn’t technically the landlord investing in your business. Indeed, there is usually a stipulation in the contract that states any fixtures and alterations conducted using the allowance remain the property of the landlord.

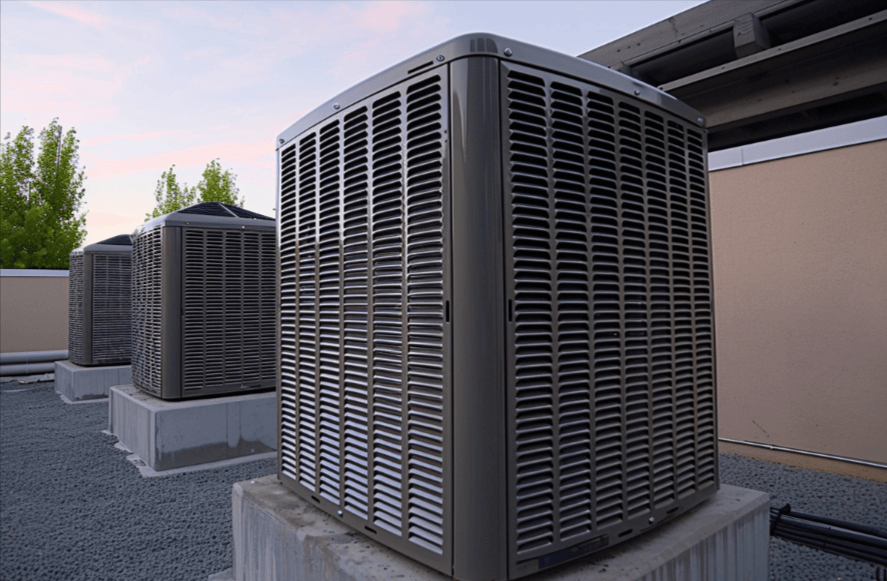

The majority of landlords will also include guidelines on what the improvement allowance can be used for. This is because they want to limit the amount of money they invest into the property to those alterations that tangibly raise the value of the premises. This means that furniture, signage, and other forms of decoration tend not to qualify for the allowance. Rather, you’re looking at structural improvements like walls and partitions or accessibility elements such as ramps. The allowance also usually covers infrastructural aspects like heating, ventilation, and air conditioning (HVAC) systems and plumbing. You may also be able to use the allowance for new carpets and a fresh coat of paint. Read more about how this intertwines with the eventual broom clean condition upon moving out.

It may also be detailed in your contract that you must seek permission for certain improvements directly from the landlord. This is particularly relevant if you want to make changes to the external areas of the property. They may also state that the improvement allowance is only applicable when you utilize their preferred contractors. As such, the extent and application of the tenant improvement allowance is something you may need to negotiate alongside the financial value.

How Much of an Allowance Can You Expect?

So, what could be considered a reasonable tenant improvement allowance amount? Well, this usually depends on the location of the property and the extent of work that needs to be done in order to put it into a functional condition. A tenant improvement allowance of $10-20 per square foot would usually be considered on the low end of the scale for most commercial properties. If you’re renting in a major city and there are significant structural alterations to be made, you can expect far more than this.

The key is to negotiate based on solid data. When you’re viewing the property, take note of everything that will need to be updated or altered in order to make it suitable for your business. Take a little time to highlight which of these falls within the usual remit for inclusion in an allowance and divide your total estimate by the square footage of the property to create your ideal allowance amount for that space. If the landlord’s initial offer falls below that amount, don’t be afraid to provide the data you’ve gathered and negotiate for an allowance closer to your needs.

This negotiation may be more difficult in properties that are in high-demand. But remember that providing a reasonable allowance to a potentially long-term commercial tenant is in their best interest as well as your own.

Do You Have to Pay Back the Tenant Improvement Allowance?

One mistake that some commercial tenants make is in thinking that a tenant improvement allowance is a form of loan that landlords arrange with their renters. This isn’t the case. You aren’t taking on any more debt and your use of the allowance certainly doesn’t impact your company’s credit rating. Having said that, there can certainly be tax implications.

While you don’t have to pay back the tenant improvement allowance, you also need to remember that assets acquired using the funds don’t belong to you. If you’ve installed an HVAC system or plumbing, you can’t take these elements to another property if you decide to move. Any improvements are the landlord’s assets.

As such, it’s wise to treat the allowance as separate from the capital of your business. Don’t incorporate it into the bookkeeping of your business, unless you are operating on a reimbursement basis. Certainly don’t include the property improvements as assets when valuing your company. You also can’t deduct the costs of alterations paid for by the allowance from your tax payments. In essence, the tenant improvement allowance is you utilizing the landlord’s capital to make changes to their property. It’s a tool you can use, but you don’t own this tool.

Wrapping Up

A tenant improvement allowance is funding provided by the landlord so you can make alterations to a property to make it functional for your business. This can take various forms, from a direct provision of funds to a discount in your rent. However, it’s important to understand that there are often restrictions for its use and any improvements belong to the landlord. It is nonetheless a vital and practical tool you can use to influence the success of your business. As such, it’s wise to go into negotiations for your improvement allowance in an informed way with the knowledge that alterations are mutually beneficial.